Finance costs are any costs involved in borrowing money to purchase or build assets. Finance costs for residential landlords include mortgage interest, loan interest to furnish the property and any fees incurred when taking out or repaying a mortgage or loan.

Individuals can claim a 20% deduction from their Income Tax liability for the sum of finance costs that were not deducted when calculating the profit. Any unused costs can then be carried forward to the next tax year.

How does it work in practice?

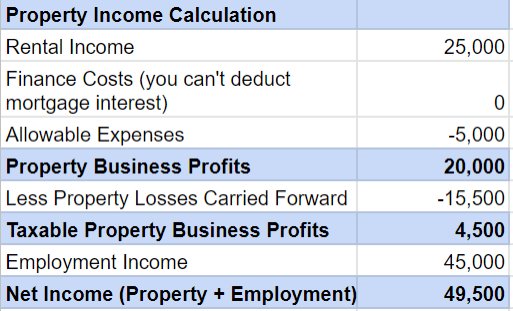

For example, Tom is a residential landlord with the following income and finance costs in the tax year:

|

Income/Costs |

Amount |

|

Employment income |

£45,000 |

|

Rental income |

£25,000 |

|

Mortgage interest |

£10,000 |

|

Allowable expenses |

£5,000 |

| Property losses carried forward |

£15,500 |

| Finance costs carried forward |

£2,000 |

Here’s how Tom would calculate his Income Tax liability using the numbers above:

He would be taxed at the following rates:

- Personal Allowance £12,570 at 0% = 0

- Basic Rate £36,930 at 20% = 7,386

- Higher Rate £0 at 40% = 0

Therefore, Tom’s Income Tax liability before deducting finance costs would be £7,386.

The tax reduction is the basic rate value (20%) of the lower of:

- Unused finance costs

Any finance costs not deducted in this tax year. In Tom’s case, this would include £10,000 of mortgage interest and £2,000 of costs carried forward from the previous tax year. This comes to a total of £12,000. - Property business profits

Any profits of the property business in the tax year after deducting any losses carried forward. In Tom’s case, this would total £4,500. - Adjusted total income

Total income (after losses and reliefs) that exceeds your personal allowance. In Tom’s case, this would be £36,930.

The lowest value is the property business profits which are £4,500. Therefore, the basic rate (20%) tax reduction is £900.

Tom then deducts that from his pre-reduction tax liability: 7,386 – 900 = 6,486.

£6,486 is Tom’s final tax liability after the tax reduction. The remaining unused residential finance costs can be carried over to the following tax year.

If you need help calculating your finance costs or income tax liability, please give us a call and we’d be happy to help